Anything over you to matter, yet not, was at chance if the bank fails. The brand new Certificate out of Deposit Account Registry Solution, or CDARS, stands for a network of financial institutions you to guarantee many for Computer game savers. You sign a CDARS location agreement and you may custodial arrangement, then dedicate currency that have a great CDARS circle affiliate. That it money is next split into Dvds granted by various other CDARS banks.

I also require a reasonable length of time to do something for the the brand new request. If the several https://happy-gambler.com/pyramid-quest/rtp/ signatures are required to interact company, we might take on anyone signed up trademark to have a halt commission purchase. You have got zero right to overdraw your bank account any time, for any reason, and you may the decision to spend overdraft transactions are solely within discernment. We would decline to pay an enthusiastic overdraft exchange at any time, even if we might have previously paid back overdrafts. If we love to shell out a deal to the overdraft, you have to make a deposit into your membership to afford overdrawn number.

Get in touch with the newest FDIC

You need to be conscious that your’re also guilty of making sure your bank account are dispersed certainly on their own chartered banking institutions to maximise your FDIC insurance policies. To have Massachusetts residents (or those people banking with Massachusetts-dependent organizations), the fresh Depositors Insurance coverage Finance (DIF) also offers endless insurance policies above FDIC restrictions. This program demands zero records otherwise special membership structuring – people amount over the FDIC’s $250,100 restrict is automatically secure in the representative financial institutions. Expertise federal reporting criteria to possess dumps more than $10,one hundred thousand is vital.

Private Account

- However, while they’re also different kinds of points, the amount of money they provide can be other.

- Brokerage profile features a built-in the payment money one facilitates all selling and buying.

- Most provides early withdrawal penalties, so always claimed’t require the currency until the identity ends.

Bitcoin made headlines international since the crypto currency already been to be popular. So it digital money now offers users the ability to handle their own fund, delight in privacy, to make smaller than average higher dumps during the casinos. BTC are available on the internet in the exchanges such as Binance and you will Coinbase. You can find safe online and traditional equipment purses so you can securely shop your coins.

2nd, if the group as energized can be regarded as incompetent at the new duration of bargain, then your bargain is emptiness. 3rd, if your bargain name try unconcsionable, then the unconscionable bargain name is gap. Pursuant on the Washington Best Legal, substantive unconscionability questions the actual regards to the brand new offer and you may examines the new cousin equity of one’s personal debt believed. Maxwell v. Fidelity Financial Services, Inc., 907 P.2d 51 (1995). “A great deal try unconscionable when it is such as no kid inside the senses rather than under delusion will make on the one-hand, so that as zero truthful and you may reasonable boy do take on for the other.” Phx.

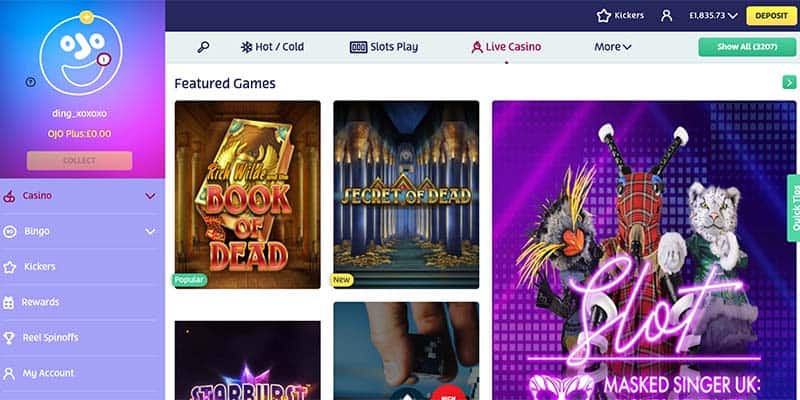

The scene stealer included in this is actually Paypal, and this convinces which have benefits. Incentives is offer your time during the a good $step one deposit on-line casino then, providing much more playtime and you may possibilities to victory. Look at the casino’s offers web page observe what’s to be had, away from invited incentives to ongoing sale, making certain you get the most value beyond only the sign-right up reward.

- Hotels may demand credit cards otherwise bucks put from the check-into protection the price of incidentals included in the standard actions plus it should be disclosed regarding the checklist breakdown.

- For the most part, a real currency names are usually $ten otherwise $20 deposit gambling enterprises.

- The newest FDIC are proud getting an excellent pre-eminent way to obtain You.S. banking world research to have experts, along with every quarter financial pages, operating paperwork, and you may condition banking results analysis.

- Mutual accounts features two or more people however, no named beneficiaries.

Other low-testamentary trust arrangements (age.grams., Attention to the Lawyers’ Faith Account IOLTAs) try treated from the Citation-due to Insurance coverage element of so it pamphlet. FDIC insurance coverage talks about deposits obtained during the an insured financial, but cannot defense opportunities, even though they certainly were bought at a covered lender. Dvds are safe assets that will help with many small-name deals desires, and you will see rates more than regular offers account features. However, Computer game prices arrive at fall in 2024 and have proceeded on the 2025.

If you’d like a more give-out of provider, financial networks can be immediately create the method to you personally, securing potentially hundreds of thousands within the places. The new Federal Put Insurance Business (FDIC) ensures places up to a limit away from $250,000 per depositor, for each and every FDIC-covered bank, for each and every possession classification — which helps make sure that your cash is protected even though the bank fails. Some banking companies do not impose strict limitations for the dollars places, specific ATMs can only manage a limited level of costs during the an occasion. For those who’lso are unsure about your financial’s limits, it’s well worth examining having support service. The new FDIC also offers an on-line calculator in order to dictate insurance coverage visibility of one’s own and you may business account, which the FDIC along with covers.